Adjustment to the Merchandise Processing Fee (MPF)

Pursuant to the provisions of the Consolidated Omnibus Budget Reconciliation Act (COBRA) and in compliance with the notice published in the Federal Register under “CBP Dec. 25–10,” U.S. Customs and Border Protection (CBP) has announced an update to the Merchandise Processing Fee (MPF) applicable to import entries, effective October 1, 2025.

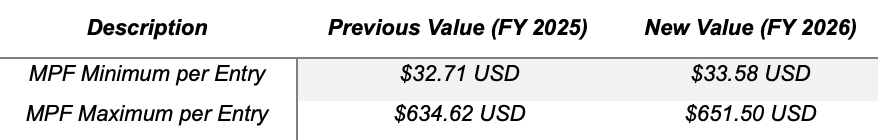

Key Adjustments

Beginning on that date, the minimum and maximum MPF amounts per entry will be adjusted as follows:

Please note that the MPF is calculated as a percentage of the customs value of imported goods, currently set at 0.3464%. However, this fee is subject to the above-stated minimum and maximum thresholds.

Implications for Foreign Trade

We recommend that compliance, logistics, and cost management teams update their import cost estimates beginning in Q4 of 2025, factoring in this adjustment in their U.S. import projections.

This modification is part of CBP’s annual update based on the inflation index, in alignment with legislative mandates governing customs service fees.

Auditoría de Activo Fijo

Evita riesgos y multas con nuestra Auditoría de Activo Fijo. Auditamos el 100% de tu maquinaria y equipo en sitio para identificar discrepancias y posibles sanciones, proporcionando un análisis detallado del nivel de riesgo y soluciones estratégicas para reducir o eliminar cualquier contingencia.

✅ Auditoría precisa y en sitio

✅ Identificación de riesgos y multas potenciales

✅ Soluciones concretas para un cumplimiento total